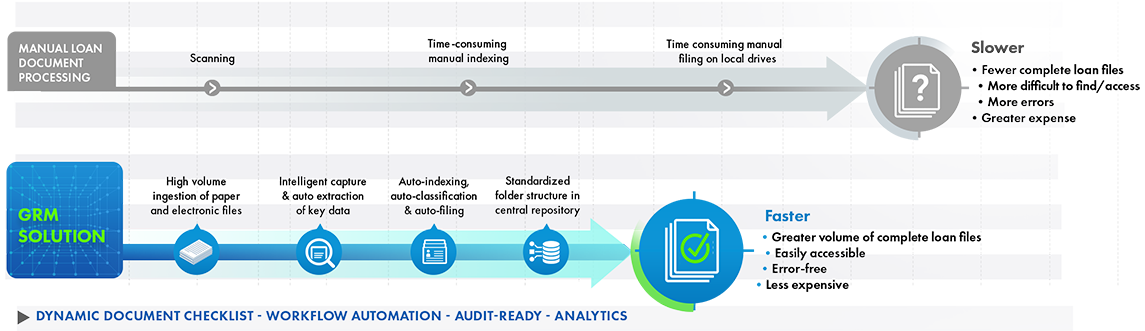

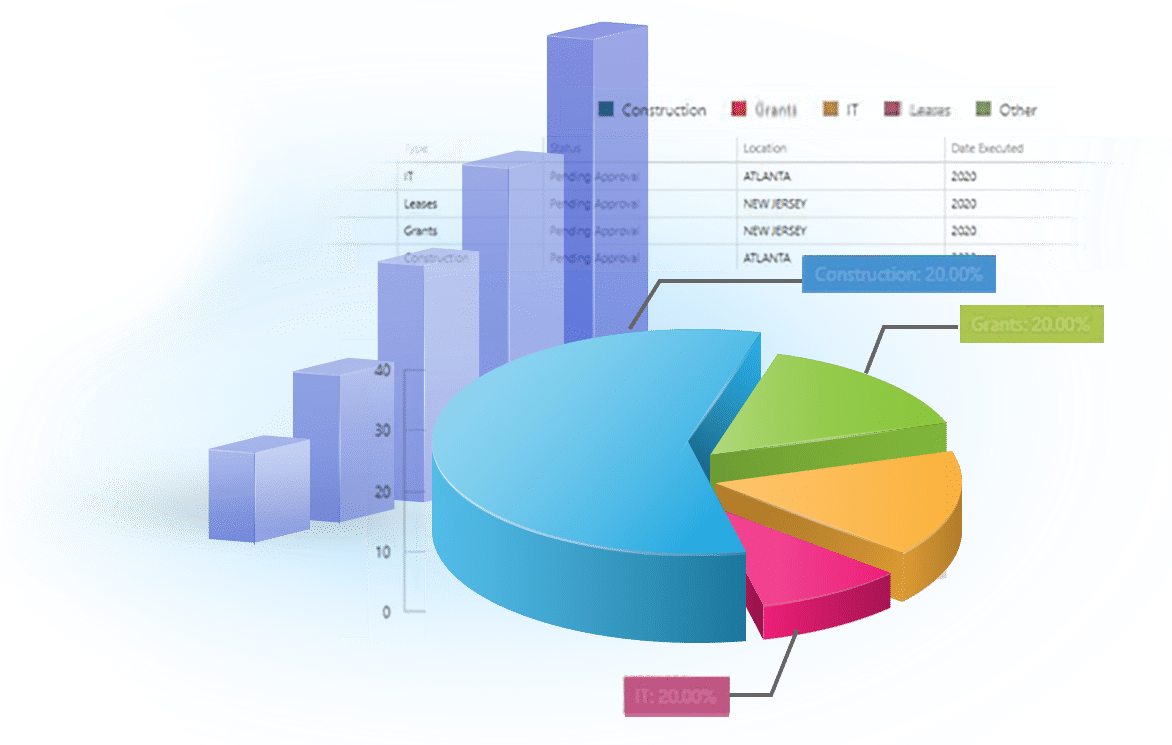

Watch To See How Grm Can Rapidly Transform Your Lending Processes.

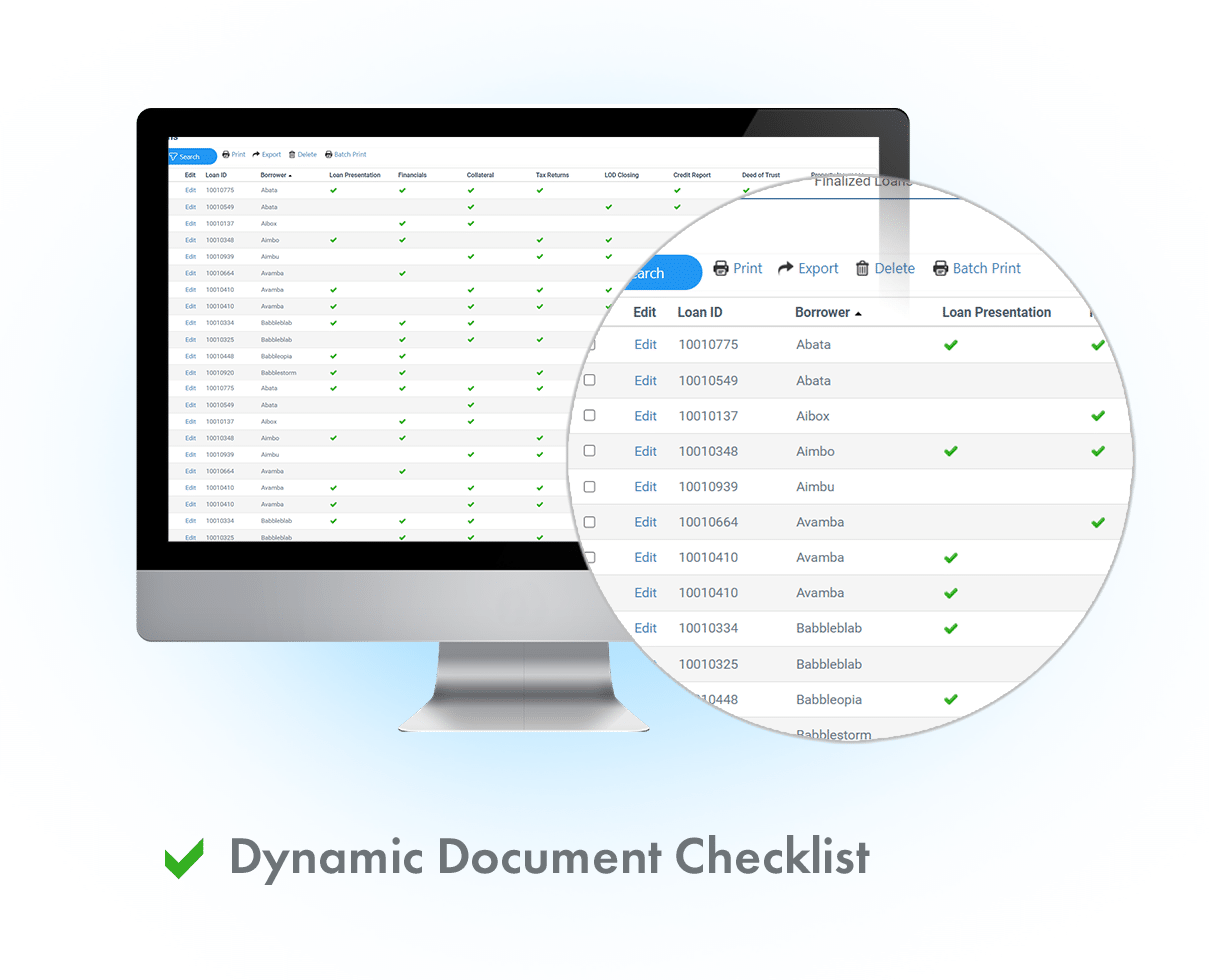

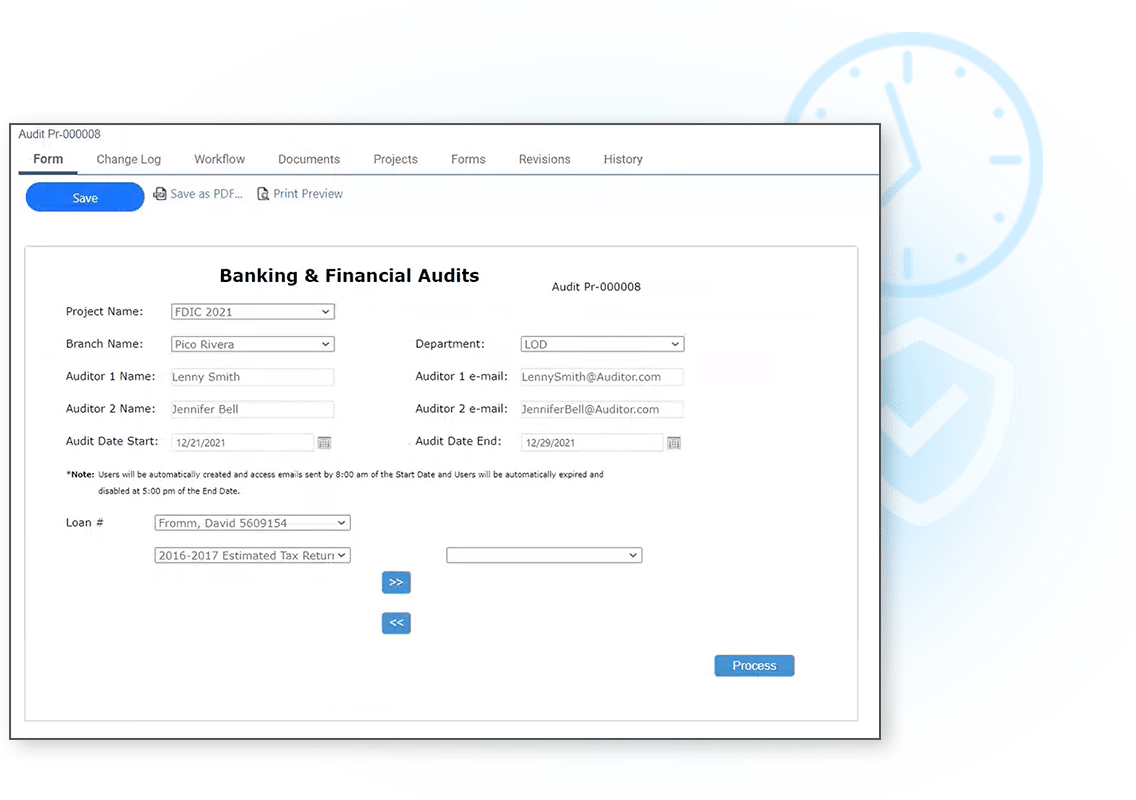

Our solution enables your loan department to process more loans in less time, securely, increasing efficiency while saving you money and delivering higher levels of customer satisfaction.